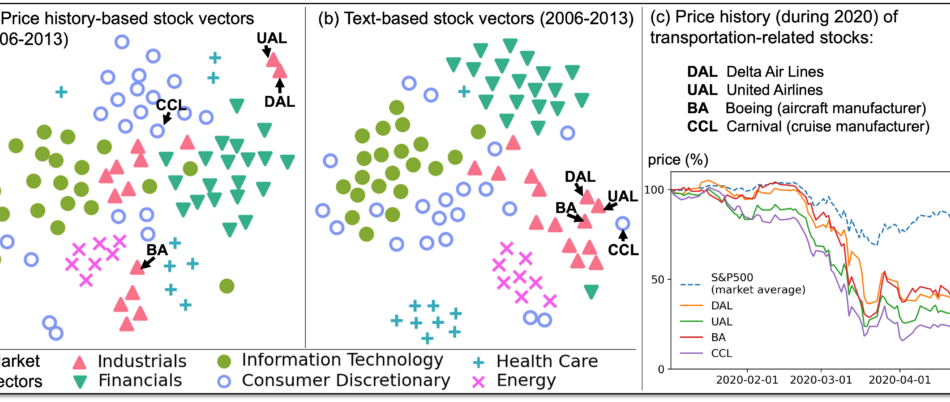

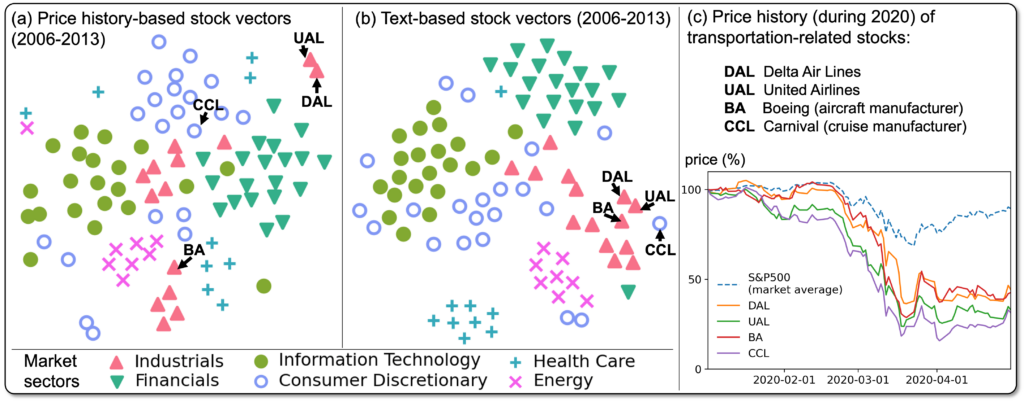

The theory of econophysics reveals the scaling properties of price, which explains why market crashes much more frequently than expected. A challenge of financial market modeling is to characterize the risks implied by extreme events, such as the COVID-19 crisis, which are rare and unable to well capture from the limited history of price data. News texts, on the other hand, are biased to such rare events and can thus be a desirable information source in addition to price history. We have studied the use of textual data for quantifying such extreme risks and its potential application.

References

- Xin Du and Kumiko Tanaka-Ishii. Stock portfolio selection balancing variance and tail risk via stock vector representation acquired from price data and texts. Knowledge-Based Systems, 2022, 249: 108917. [link]