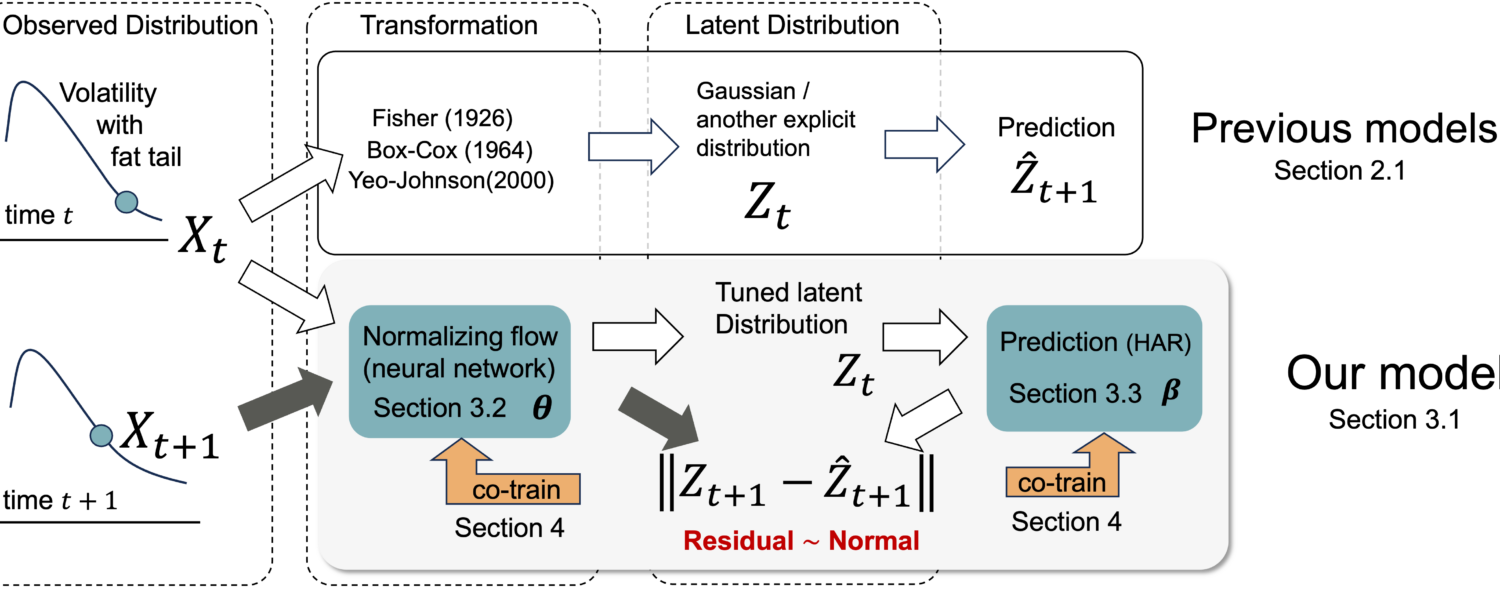

This paper shows a novel machine learning model for realized volatility (RV) prediction using a normalizing flow, an invertible neural network. Since RV is known to be skewed and have a fat tail, previous methods transform RV into values that follow a latent distribution with an explicit shape and then apply a prediction model. However, knowing that shape is non-trivial, and the transformation result influences the prediction model. This paper proposes to jointly train the transformation and the prediction model. The training process follows a maximum-likelihood objective function that is derived from the assumption that the prediction residuals on the transformed RV time series are homogeneously Gaussian. The objective function is further approximated using an expectation–maximum algorithm. On a dataset of 100 stocks, our method significantly outperforms other methods using analytical or naïve neural-network transformations.

References

- Xin Du, Kai Moriyama, and Kumiko Tanaka-Ishii. Co-Training Realized Volatility Prediction Model with Neural Distributional Transformation. In Proceedings of 4th ACM International Conference on AI in Finance. Brooklyn, New York, 2023. p. 418-426. [paper]